Did digital banks fail to disrupt?

Most became niche players, yet served their regulatory purpose, said McKinsey associate partner Hernán Gerson.

They were touted as game changers, expected to revolutionise the banking industry and cause major headaches to the “old” incumbents. Yet, in the decade since the massive boom in digital-only banks—also known as virtual banks, neo banks, and challenger banks, amongst a plethora of other titles—only a select few have managed to reach profitability.

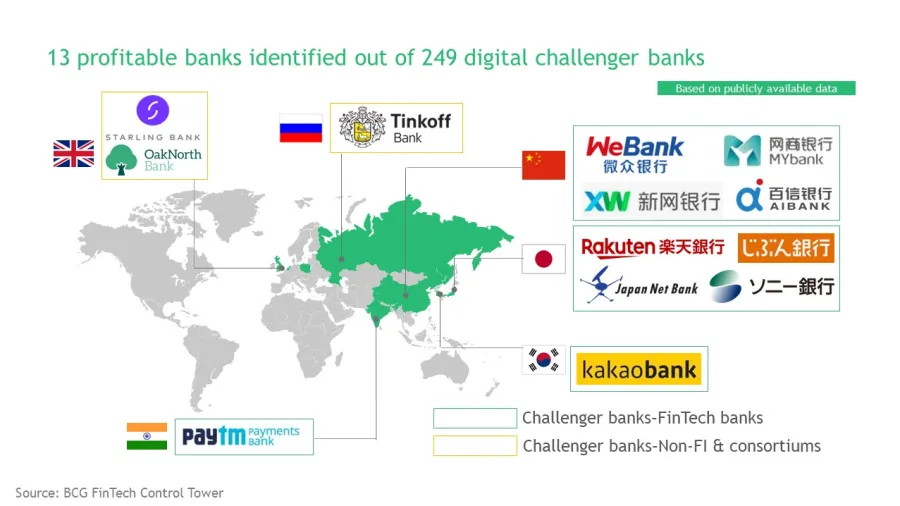

Of the almost 250 challenger banks in the world, only 13 are profitable as of end-2021, according to data from the Boston Consulting Group (BCG). In Asia, only 10 are profitable of the 50 challenger banks operating in the region.

“There was a lot of hype, and some of the hype may be due to companies themselves trying to get a better valuation,” Michael Makdad, senior equity analyst for Morningstar. “A lot of it was media-driven [too] because to the media it was something new. So they’re like, ‘Oh, wow, disruption.’ Now that banks have not lived up to the media’s expectations, they see it as a disaster, Makdad noted.

This should not be the case, Makdad, along with other industry experts told Asian Banking & Finance.

“The expectation for digital banks depends on your point of view. Consumers, regulators, and investors have very different expectations,” said Hernán Gerson, associate partner, McKinsey & Company. “[One] of the reasons why [regulators] allowed digital banks to enter the market is for consumers and customers in general. The digital banks were able to deliver a customer-centric proposition with end-to-end digital choice, and in many cases, with much lower fees, and much lower pricing than incumbents.”

This, Gerson said, pushed incumbents to ramp up their digitisation drives, even before the pandemic struck.

ALSO READ: Banks lagging behind net zero energy goals

Looking back

Whilst the interest and subsequent boom in handing out digital bank licenses only really began during the mid-2010s across Asia, there was one country in the region that has licensed challenger banks as far back as 2000: Japan, where challenger banks have been profitable for more than a decade, according to Makdad.

Models vary. Two of the banks—Seven Bank and Lawson—have a business model of generating profits from fees on ATMs located in convenience stores rather than from making loans. Aeon Bank’s business model, meanwhile, focuses on the low-cost operation and retail banking.

For the rest of Asia, digital banks only emerged at the forefront of the banking industry in 2014, spurred by China’s decision to hand out licenses to Ant Group’s MyBank and Tencent’s WeBank.

Following this, South Korea handed out licenses in 2015, from which two players emerged: KBank and Kakao Bank, launching in 2017. A third virtual bank, Toss Bank, launched in October 2021.

These four digital banks in South Korea and China—MyBank, WeBank, KBank, and Kakao Bank—are now all profitable. It was a story that other digital banks across the region are struggling to emulate.

Time may be one reason why.

“It usually takes 5-7 years to break-even for a typically successful digital challenger bank. In Hong Kong and Taiwan, digital challenger bank licenses were given in 2020 and 2019 – only 3 to 4 years ago,” JungKiu Choi, Managing Director and Partner, Boston Consulting Group (BCG), told Asian Banking & Finance in a written correspondence.

But even after 5-7 years, profitability is not guaranteed, Choi noted. He placed the 10 successful challenger banks in Asia into 2 categories: those who are able to leverage their ecosystems and brand names; and those with a strong fintech background.

Ecosystems

The advantage of MyBank, WeBank, and Kakao Bank—which outpaced rival KBank to become profitable in 2019, versus KBank’s 2021—is their connection to their parent companies’ platforms.

“What is interesting about South Korea and China is that most of the successful digital banks there are linked to an ecosystem,” Gerson said. “These ecosystems allow them to tap very cheaply into millions of customers.”

The ones who know how to leverage their unique ecosystem, build a crisp and differentiated customer value proposition that can spur deep customer obsession, and who know how to leverage big data and data analytics, with a clear path to profit will be in a greater position to meet with success, BCG’s Choi added.

“The ones who do not come up with a differentiated value proposition and fail to leverage their ecosystem well (which may result in high customer acquisition costs) would not be able to breakeven,” he further warned.

ALSO READ: Intent vs ability: Why lending models must be revised to foster financial inclusion

Costs are a key factor determining the success of a digital bank. According to McKinsey, the customer acquisition costs for digital banks linked to an ecosystem can be as low as 10% of the average acquisition costs of traditional banks. “We're talking about less than $5 per customer,” Gerson said.

“And digital ecosystems provide a unique advantage to reach customers at scale efficiently. So the digital banks that are actually part of an ecosystem or can partner with an ecosystem will be able to provide the right value proposition to customers,” he added.

These ecosystems, especially in China and South Korea, provided unique data for the banks as well.

Economic moats

The strength of incumbent banks within the market is another important factor that digital banks should consider regarding their chances for success.

“One of the things that enables a digital bank to succeed or not is if they have an economic moat. For a virtual bank to get an economic moat, I think it would need something like a strong internet platform, but also if the incumbent banks themselves have strong moats or not,” Makdad said.

For example, Japan’s incumbent banks, in Morningstar's view, do not have economic moats.

“There's already too much competition in Japan; MUFG, SMBC, all these big banks in Japan compete very strongly against each other. None of them has a very strong advantage. In Korea as well, we also think they don't have economic moats,” Makdad added.

In contrast, Singapore’s big three banks– DBS, OCBC, and UOB– all have narrow moats. This gives the three banks a cost advantage.

“So if any other foreign bank or if somebody gets a banking license in Singapore and starts up a bank, they're going to have trouble competing against the cost advantage of the incumbent banks in Singapore,” Makdad noted.

No COVID boom

The onset of the pandemic did no unique favors to the digital banks, either, despite the fact that it pushed more people to use digital services. Data from McKinsey & Co. showed that the adoption of digital services accelerated four years in just the first six months of the pandemic, with the share of APAC companies’ digital interactions jumping to 53% in July 2020 from just 32% in December 2019.

McKinsey & Co. partner Bharath Sattanathan named two factors as to why digital banks did not benefit from the pandemic’s digital boom.

“If you looked at it more broadly across the region, there were probably two factors to consider in terms of what happened during COVID. One was that a lot of these digital banks were very young during the COVID period, or they had very specific or very niche service offerings for their customers,” Sattanathan told Asian Banking & Finance.

“The second reason is, the [incumbent] banks really upped their game during the COVID period, right, considering all the complications. The banks really came to party when it came to increasing their digitalization, increasing their service offerings online. In many ways, a lot of the banks moved mountains to be available fully online for their most important products and services,” he said.

ALSO READ: How Asian banks can retain their cross-border dominance

Both of these factors meant that customers who needed to access banking services remotely still got what they wanted with their existing service providers.

“There was no reason for them to look at things outside, particularly when something's so small or so young at that stage of evolution,” Sattanathan noted.

For Hong Kong and Taiwanese digital banks, it might be too early to predict or conclude why they did not benefit from the digital boom, noted Choi, but he did give three reasons why they were not attracting as many local customers.

“[First] digital banks in Hong Kong and Taiwan are still at their early stages; [second] their value proposition is not unique and compelling enough yet. The strength of any digital challenger bank is the speed and agility of adoption, and they would typically go through many iterations to improve their value proposition and product features as they evolve; they have not formed an ecosystem powerful enough to create unstoppable momentum,” Choi said.

Turning a profit

Factors such as inclusion in an ecosystem and the strength of incumbent banks in the market alongside the right value proposition are key for banks to make a profit.

Partnerships are especially key for neo banks to scale their operations, Gerson said.

“Rethink partnerships. Look very broadly; who are the players in the market? Are there retailers, are their e-commerce platforms, are there messaging apps, what is out there? Who could be your right partner? Think about this very carefully. Every market is going to be different,” Gerson said. “Think about how you can establish a partnership that can benefit your partner, the consumers and yourself. If not, it will not work.”

Paul Sommerin, partner and head of digital and technology at Capco, advised banks to look beyond promotions.

“Understand what the customer really wants after the high-interest rate deposit rate promotion ends. I have also noticed that digital banks—once the promotion period ends—tend to focus on acquiring new customers rather than keeping their existing customers satisfied, thus creating churn,” Sommerin said.

For his part, Choi noted that from the get-go, digital banks are born to be niche, built with specific groups in mind, mainly for retail customers and SMEs, and not so much for large corporations.

“Building and sustaining a profitable and successful digital challenger bank is not easy, so it’s critical for upcoming digital banks to carefully consider what their unique advantage to win in the market would be,” Choi said.

ALSO READ: How Asian banks can retain their cross-border dominance

He advised banks to leverage their ecosystems in order to acquire customers at a low cost, and to bring a differentiated value proposition to customers, and build product features that are not easy to copy.

Digital risk management is another factor that digital banks should take note of.

“For example, you need to build straight-through processing from end to end, with 100% automated digital processes and credit approval, and with early warning and collection models. You need to embed the three lines of defense as algorithms into the risk control measures of your operations,” Choi said.

Finally, Choi said to carefully design a path to profit, factoring in the valuation of your current tech, and short-term corrections in the global capital markets.

Advertise

Advertise