Cards & Payments

Atome’s BNPL debuts on Taobao Singapore

Atome’s BNPL debuts on Taobao Singapore

Every Saturday, Atome shoppers can enjoy a $12 off for a $120 minimum spend.

Indonesia, UAE team up to promote local currency use in bilateral transactions

UAE and Indonesia's non-oil trade grew to $3.1b between 2017 and 2023.

Taiwan e-payments rose to $475.4m in Q1

A total of 1.897 billion non-cash payment transactions have been recorded.

Taiwan cards' revolving credit rise to NT$107.3b in March

There are over 37 million active credit cards on the island.

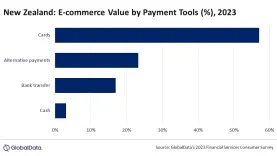

Chart of the WeekL 1 in 2 e-commerce purchases in New Zealand use payment cards

Cash accounted for just 3% of all e-commerce payments.

Alipay+ expands to Nepal thru Nepal Clearing House partnership

Ten mobile wallets and bank apps can now pay using NEPALPAY QR.

PH fintech BillEase integrates QRPh in platform with AUB partnership

BillEase customers can now pay at over 600,000 QRPh-accepting merchants.

Ant Int'l inks MOU to ramp up Saudi Arabia expansion

The Ministry of Investment of Saudi Arabia formally expressed support for Ant’s plans.

National Australia Bank, Banked eyes boosting A2A payment adoption

Their tech enables Australian merchants to send PayTo Agreements to customers.

India’s ICICI enables non-resident Indian customers to make UPI payments

The service is available through the iMobile Pay app.

UOB to maintain good asset quality amidst profitability dip

The bank is also expected to have a steady core capital ratio.

Alipay’s labor day outbound travel transactions up 77% in 2024

East Asia and Southeast Asia were the most preferred destinations.

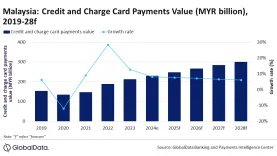

Malaysia’s credit, charge card market value grows to $50.5b in 2024

Credit and charge cards make up 60% of all card payments in the country.

How banks should rethink pricing

It’s not just about how much customers pay but also what benefits they get.

Alipay+ enables 14 foreign e-wallets to pay in Hong Kong

About 90% of HK merchants now accept payments using foreign e-wallets.

Alipay+ inks deal with Jeju tourism org for exclusive offers to foreign visitors

Foreign visitors can enjoy up to 50% discounts from ZeroPay merchants.

Nium, Thredd expand virtual card partnership

The two fintech companies have issued 86 million virtual cards worldwide.

Advertise

Advertise