Krungsri

Bank of Ayudhya, branded and commonly referred to as Krungsri, is the fifth largest bank in Thailand by assets. The bank officially opened its doors on April 1, 1945.

Krungsri is one of Thailand's leading players in personal loans, credit cards, and auto hirepurchase with market shares of 26%, 15% and 29%, respectively, at end February 2022.

The bank became a subsidiary of MUFG Bank in 2013. MUFG Bank is a wholly-owned subsidiary of Mitsubishi UFJ Financial Group (MUFG), Japan's largest banking group and one of the world's largest financial groups.

Thai banks’ weak loan problem starts to bite: analyst

Thai banks’ weak loan problem starts to bite: analyst

Provisions for expected credit losses now average 30%.

Thailand’s Krungsri launches SME transition loan for clean energy

It will help businesses embrace clean energy solutions and reduce pollution.

Six Thai banks to sustain improved earnings through 2026: Fitch

They are well-positioned to face risks after years of excessive provisioning.

Krungsri sees FX profits rise 21% in Q1

Digital FX transactions is 64% higher year-to-date.

Thailand’s Krungsri net profit up 7.2% in 2023

Contributions from overseas businesses drove up loan growth and fee income.

Thailand’s Krungsri teams up with Klook to elevate position in travel market

Exclusive privileges will be offered to the bank’s customers.

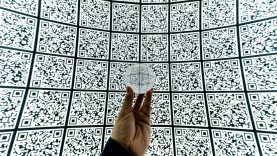

Krungsri launches cross-border QR payments to Hong Kong

Travelers need only to pay using the KMA krungsri app.

Thailand’s Krungsri sets sights on Vietnam expansion with SHB Finance acquisition

Krungsri will acquire the 50% remaining shares of SHB Finance over the next three years.

Bank of Ayudhya’s profitability recovers to pre-pandemic levels

Bad loans are expected to stay at a ratio of 3% over the next 12 to 18 years.

Thailand plays catch up with global green finance goals

Banks are calling for legislators to impose carbon tax and a common taxonomy of goals.

Security Bank’s SB Finance launches Car4Cash in the Philippines

Car owners can gain access to as much as PHP2m.

Advertise

Advertise