This is why the currency's decline is credit positive for Australian banks

It reduces the banks' offshore funding task.

Moody's notes that on 1 August, the Australian dollar (Aussie) fell below $0.90 for the first time in many years, and is down 13% since 1 May, when it was at $1.04.

"The currency’s decline is credit positive for Australian banks because it will help alleviate growing asset quality challenges and improve their funding. A lower Aussie will also provide currency translation benefits and will boost the earnings of banks with significant offshore revenue streams, such as Australia and New Zealand Banking Group Limited and Macquarie Bank Limited."

Here's more from Moody's:

A weaker Aussie will alleviate pressure building on Australian banks as a result of the country’s economy undergoing a gradual shift owing to the resource-sector investment boom moderating and a question about whether non-mining exports, corporate investment and household consumption can mitigate that slowdown. This exposes bank asset quality and profitability to material downside risks.

Australia’s flexible exchange rate has historically served as an effective shock absorber, preventing the economy from entering recession. Indeed, in the wake of the global financial crisis, the currency depreciated by more than 30%, boosting net exports.

A sustained weaker Aussie now will similarly alleviate pressure on export-oriented sectors of the economy, such as tourism and manufacturing, and reduce the threat of banks’ asset-quality deteriorating.

A weaker currency would also help banks with significant offshore operations because a lower Aussie increases the value of revenues earned offshore after translation into local currency.

ANZ and Macquarie earn a higher proportion of their income from offshore than other Australian banks (16% for ANZ and 63% for Macquarie, excluding revenue from New Zealand).

Although the banks hedge a portion of these earnings, currency translation benefits are a material positive. Macquarie estimates that a 10% decline in the Aussie results in approximately a 6% increase in full-year earnings.

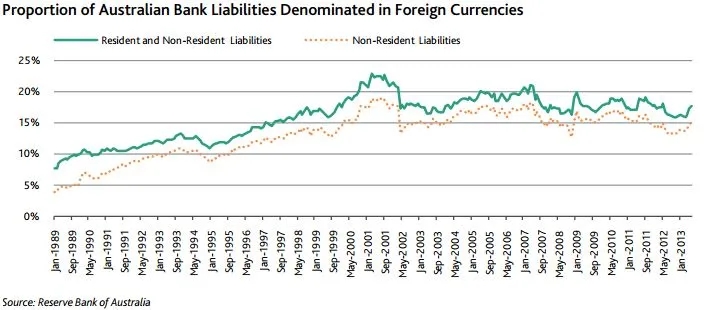

A weaker Aussie also has funding benefits. As the graph shows, a large proportion of Australian banks’ funding is denominated in foreign currencies and sourced from offshore wholesale markets.

A falling Aussie reduces the offshore funding task of the banks because it requires a lower level of foreign currencydenominated issuance to fund their Aussie-denominated assets. Given Australian banks’ traditionally high exposure to confidence-sensitive offshore funding markets, any reduction in this exposure is credit positive.

In addition, because the banks typically hedge their foreign currency issuance, a decline in the Aussie results in an in-the-money swap position and leads to an inflow of collateral to Australian banks from their swap counterparties.

We estimate such inflows will be AUD450-AUD500 million for each one cent movement in the AUD/USD exchange rate for ANZ and National Australia Bank Limited and higher for Commonwealth Bank of Australia and Westpac Banking Corporation.

Although this does not present longer-term benefits as the collateral flows may reverse as the Aussie stabilizes or rises, such inflows improve short-term liquidity.

Advertise

Advertise