Singapore's medical tourism ambitions falter as Malaysia steps up

Malaysia offers more competitive surgery costs with a heart bypass costing just US$14,000 compared to US$23,000 in Singapore.

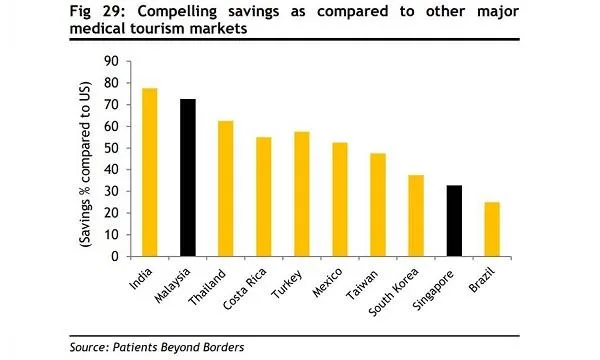

Malaysia’s rise as a regional medical tourism hub comes at the expense of Singapore, which is rapidly losing market share to its neighbour which is able to offer cheaper healthcare and compelling savings to tourists, according to Maybank Kim Eng.

For instance, surgery costs in Singapore are pricier than Malaysia and Thailand. A heart bypass costs US$23,000 in Singapore, although patients going through Malaysia and Thailand need only shell out US$14,000 and US$13,000, respectively. A knee replacement process costs US$16,700 in Singapore but costs only US$10,900 in Malaysia and US$11,400 in Thailand. Similarly, patients needing gastric bypass surgeries can save US$11,400 if they go to Malaysia where the surgery goes for US$8,600 compared to US$20,000 in Singapore and US$16,700 in Thailand.

Also read: Singapore's staggering healthcare costs may be pushing medical tourists away

Private inpatient bills in Singapore have grown at 9% p.a. clip during 2007-2017, outpacing the 4.9% p.a. growth of Class A (public sector) inpatient bills, according to analyst Lai Gene Lih. The rapid medical inflation prompted the Ministry of Health to publish non-binding fee benchmark guidelines for surgical procedures. In a separte report, Aon forecasts medical inflation in Singapore to hit 10% by end-2019, outpacing general inflation levels of 1% and the global average of 8%.

Doctors and nurses in Singapore also enjoy higher pay compared to their peers in Malaysia and Thailand, noted Lai, implying a heavier cost burden on the city's healthcare providers that could be transferred to patients.

Also read: Singapore needs to control inpatient costs amidst high medical inflation

Singapore’s fading price competitiveness is also partially due to the strong SGD compared to regional currencies.The MYR has appreciated at a less benign rate of 21% against the IDR over 2013-2018, as compared to 34% for the SGDIDR. “Looking ahead, the Maybank currency team forecasts the SGDIDR to be 2% lower by end-2019 vs 2018, and the MYRIDR to be flat in the same time frame,” the analyst added.

The growing cost competitiveness of Malaysia brings bad news to Raffles Medical Group (RMG) but bodes well for HMI’s Mahkota Medical Centre (MMC) in Malaysia as they both embark on aggressive expansion plans in a race to cater to the growing affluence, increased insurance take-up, older age demographic shift and burden on public healthcare systems, according to Lai.

RMG is also losing market share to high-end players like IHH. In Singapore, RMG’s revenue growth has lagged IHH’s Singapore operations since Q4 2016. “We believe one of the reasons may be because IHH’s Singapore hospitals, such as Mount Elizabeth and Gleneagles may be more effective in attracting price-inelastic customers,” he said.

On the other hand, Malaysia’s MMC remains well positioned to enjoy positive structural industry factors from medical tourism with its 10% market share in the country’s medical tourism market in Malaysia and over 80,000 foreign patients annually.

“From the angle of medical tourism, we favour HMI’s prospects over RMG’s,” he added. “Over the longer term, we continue to believe that Malaysia will continue to gain medical tourism market share from Singapore, particularly from Indonesian medical tourists. Indonesia accounts for over 60% of medical tourism receipts/ medical tourists for Singapore and Malaysia respectively.”

However, Singapore can still hold its ground in attracting deep-pocketed medical tourists especially in more complex treatments like oncology, ophthalmology, organ transplants, stem cell treatments and neurological surgeries. This dynamic however is set to benefit premium service providers like IHH rather than RMG which targets the medical mass market.

Advertise

Advertise