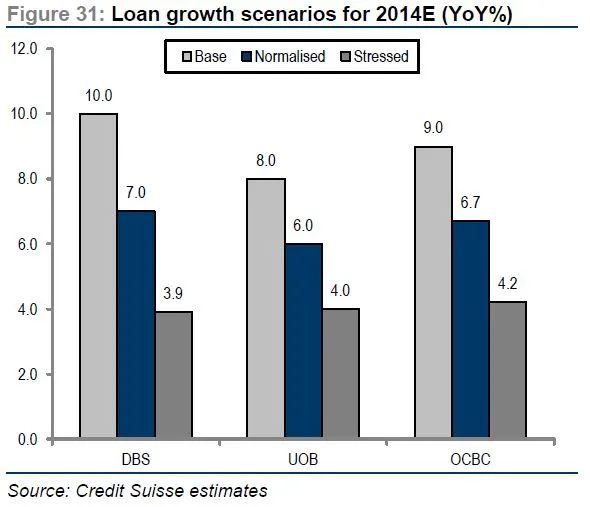

This graph shows possible 2014 loan growth scenarios for Singapore banks

Overseas markets are key drivers of slow growth.

According to Credit Suisse, the key drivers of a slowdown in loan growth could be overseas markets—ASEAN (UOB, OCBC), Greater China (OCBC) and India (DBS, if management decides to shrink loan book significantly).

Here's more from Credit Suisse:

But the probability of a Greater China-driven slowdown appears increasingly unlikely—lowering the downside risks for DBS significantly. As a result, UOB and OCBC are probably at a higher risk of an ASEAN-driven slowdown.

Importantly, loan growth in itself is not a big driver of bank earnings. As a result, even if there is a divergence in overall loan growth (assuming NIMs remain flat), it is unlikely in itself to drive a big variance in earnings growth expectations.

Advertise

Advertise