Philippine banks revel in breakneck consumer credit growth

But credit costs will rise as a result.

The fear of slowing loan growth has gripped banks across Southeast Asia, but Philippine lenders seem surprisingly immune to the affliction plaguing their peers. Systemwide loan growth stood at a robust 14.8% in the first quarter of 2016, significantly stronger the 13.1% recorded in December 2015.

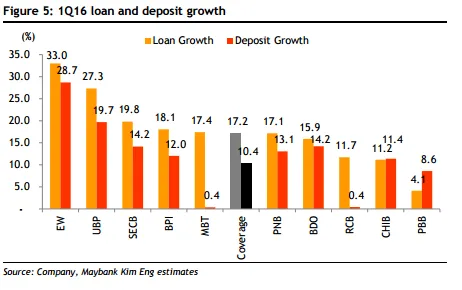

This chart from Maybank Kim Eng shows that the archipelago's largest banks enjoyed robust loan growth during the quarter. Consumer-focused Eastwest Bank led gains in Q1, with overall loan growth up 33% and consumer loans surging 44%. Other strong gainers include Unionbank at 27.3%, Security Bank at 19.8%, and Bank of the Philippine Islands at 18.1%.

Maybank Kim Eng noted that the robust loan growth in March was driven by stronger consumer lending, particularly in terms of motor vehicle financing, salary-based loans, and credit card receivables.

Analysts reckon that Philippine banks will continue to enjoy double-digit loan growth this year, although overall expansion will slow on a year-on-year basis.

"Increased political uncertainty and ongoing regional economic weakness could weigh on the Philippine banking sector over the coming months. That said, continued strong domestic demand should provide a support to loan growth, while the banking sector should be able to withstand headwinds thanks to its strong balance sheet," BMI Research said in a report.

Meanwhile, S&P expects corporate loan growth to moderate this year on back of heightened macro-prudential measures. Consumer loans, on the other hand, will continue to grow robustly this year.

"Philippine banks' pursuit of consumer loans could result in higher credit costs, given the inherently higher risk in this segment in a growing economy. Loan growth, particularly to the corporate sector, will likely keep moderating as well unless public infrastructure and development projects kick in under the government's public-private partnership scheme. We expect net interest margins of Philippine banks to strengthen as the proportion of higher-yielding consumer loans rises," S&P said.

Advertise

Advertise