ASEAN banks' asset quality to suffer as regional slowdown bites

Will there be a sharp spike in delinquencies?

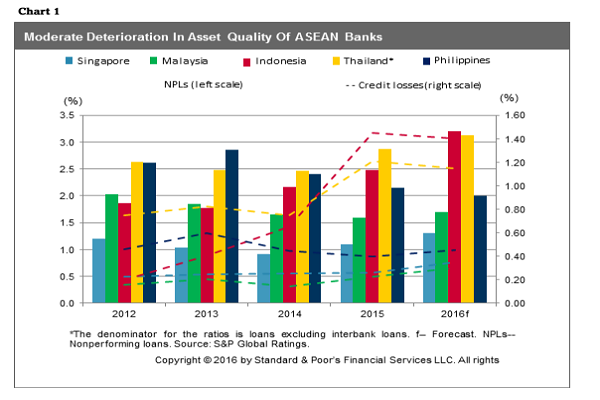

Banks in Southeast Asia will see a broad-based increase in non-performing loans (NPLs) this year, according to a report by S&P.

"In our opinion, 2015 was the turning point in the credit cycle for most ASEAN banking systems, and nonperforming loans (NPLs) will continue to rise in 2016," the report said.

However, S&P said that asset quality deterioration to be gradual and a sarp spike in delinquencies should not be expected.

In Singapore, the key risk for banks is the quality of overseas loans, particularly to emerging markets like Indonesia and India. In Malaysia, meanwhile, the key risks are low commodity prices, high household debt, and heightened political uncertainties.

In Thailand, NPLs will rise on back of high household leverage and continued economic weakness, particularly because of the absence of a stable elected government. In Indonesia, meanwhile, loans to commodity players and SMEs might push up banks' overall NPL ratio.

Lastly, in the Philippines, banks' pursuit of consumer loans could result in higher credit costs, given the inherently higher risk in this segment in a growing economy.

"Asset quality has been deteriorating and loan growth has been reducing, largely due to a slowing regional economy and a decline in commodity prices. However, S&P Global Ratings expects most banking systems in the region to remain resilient to external macroeconomic headwinds. Their fair-to-satisfactory profitability and generally sound capitalization should mitigate an erosion in asset quality," the report said.

Advertise

Advertise