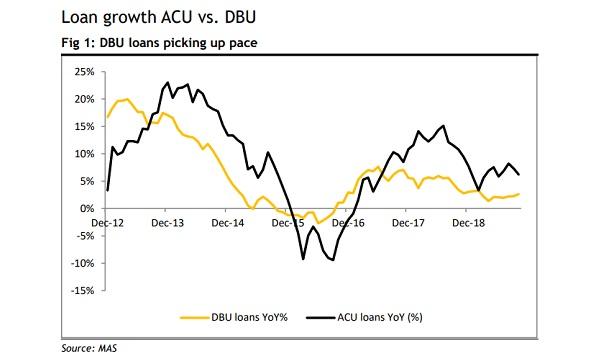

Chart of the Week: Singapore domestic loans up 2.6% in October

This is its fastest expansion since February 2019.

October saw Singapore banks’ domestic loans (DBU) rise 2.6% YoY, their fastest pace since February and suggesting a pick-up in economic activity, according to a report by Maybank Kim Eng. Overseas loans (ACU) remained resilient to a 6.2% YoY growth in October from the 7.3% YoY increase posted in the previous month.

Overall loan momentum softened to a 4.4% YoY expansion in October from the 5.1% YoY rise in August, data from the Monetary Authority of Singapore revealed. Despite the slower climb, loan growth remains at a respectable pace given the backdrop of slowing macroeconomic conditions, noted Maybank Kim Eng analyst Thilan Wickramasinghe.

Domestic business loans rose by 5.2% YoY, their strongest since February. This was driven by a 3.2% YoY expansion from the general commerce sector, reversing its trend of contractions since a year ago.

“This may signal a pick-up in SME activity, in our view,” commented Wickramsinghe.

Conversely, domestic consumer loans continued to for the sixth consecutive month, falling by 1.2% YoY, dragged down by a 1.4% YoY contraction in mortgages.

Consumer lending drove overseas loans upwards to a 6.2% YoY growth, although this was lower than the growth in September.

“We attribute the latter partly to private-banking activities. Overall positive momentum should provide some compensation for weaker margins from falling interest rates,” said Wickramsinghe.

Nevertheless, loans for manufacturing, construction, and business services grew by 11% YoY, 9% YoY, and 33% YoY, respectively. Wickramsinghe noted that this signifies continued capacity relocation from China to ASEAN, which should drive ACU-loan demand in the medium term, given the slow burn of large capital-intensive projects.

Overseas mortgages climbed increased 6.2% YoY in October, their best clip since February 2018, likely driven by private banking as clients diversified their property holdings from markets such as the US, Europe and Australia.

Advertise

Advertise