Hong Kong’s ZA Bank welcomes planned stablecoin regulatory regime

The bank surpassed $1b in transfer turnover from Web3 clients in 2023.

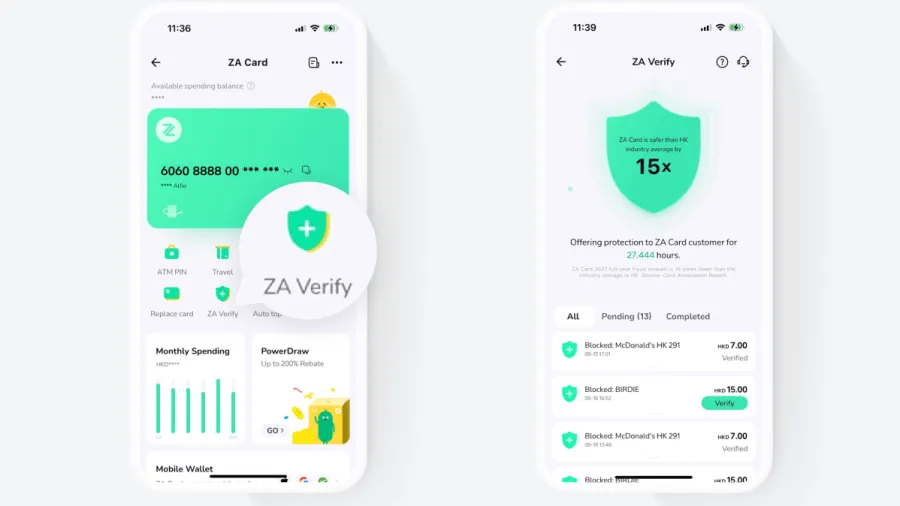

Hong Kong’s first virtual-only bank ZA Bank welcomed Hong Kong’s plans to introduce a regulatory regime for fiat-referenced stablecoins (FRS).

The Hong Kong Monetary Authority (HKMA) and Financial Services and Treasury Bureau (FSTB) have issued a consultation paper on plans to regulate stablecoin issuers.

“We believe that introducing a regulatory regime for FRS issuers to facilitate proper management of the potential monetary and financial stability risks, whilst providing transparent and suitable guardrails, is a highly suitable and effective approach,” ZA Bank said in a statement.

ZA Bank added that the regulatory regime will contribute to the “sustainable and responsible development and promotion of stablecoins, as well as the thriving Web3 ecosystem, in Hong Kong.”

ZA Bank had earlier launched dedicated banking services for stablecoin issuers, part of its growing financial services to Web3 clients.

“We also agree that safekeeping reserve assets with licensed banks in Hong Kong can offer enhanced user protection in the event of FRS issuers’ business disruptions or failures,” ZA Bank stated.

Advertise

Advertise