This graph isn't enough proof that Singapore banks did well in August

Numbers are high, but MAS is still worried.

According to CIMB analysts Kenneth Ng and Jessalynn Chen, system loan growth was moderate in Aug (+0.7% mom, +11.4% YTD) as the demand for business loans fell.

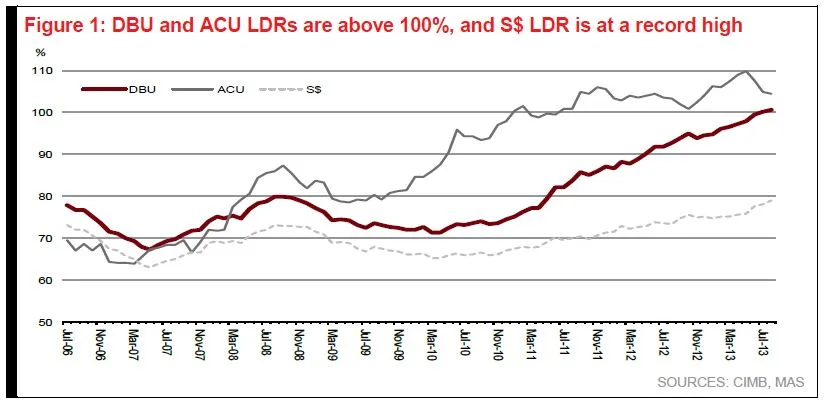

DBU loan growth was weak (+0.3% mom, +10.2% YTD), with the lower manufacturing and commerce loans offsetting the rise in credit cards, share financing, other consumer loans and mortgages. DBU deposits remained flat mom, which drove the DBU loan-to-deposit ratio (LDR) up 0.4% pts to 100.5%.

Ng and Chen further said that S$ LDR rose 1% pt to a high of 79.0%, while the ACU LDR fell 0.5% pts to 104.5%. Meanwhile, the credit card charge-offrates c ooled 40bp to 4.72% in Aug.

DBU LDR crossed the 100% mark in Jul, which means that the system is relatively stretched. While there is still excess S$ liquidity (S$ LDR was 79.0% in Aug), the rising S$ LDR means that funding pressure may show up in future if this trend continues.

According to Ng and Chen, the main cause of this is the falling S$ deposits as investors seek higher returns elsewhere in a low interest rate environment.

"We expect the loan growth to slow in 2H, which is in line with the three local banks’ guidance. System loan growth looks set to reach +12-14% by end-2013," the analysts said.

They warned though that MAS is still concerned about the rising credit card debt and unsecured credit earlier this month. But the good news is that the credit card charge-off rates fell below the historical average of 4.95% in Aug – signaling that consumers’ credit quality remains sound.

Ng and Chen believe the domestic NPLs will not be a cause of concern for the local banks, but rather the small pots of NPLs arising out of India, Indonesia and Malaysia.

Advertise

Advertise