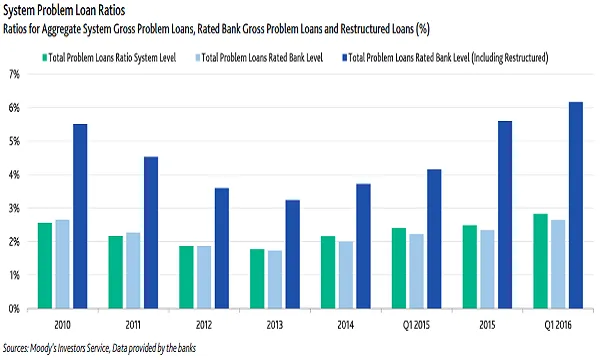

Chart of the Week: What caused Indonesian banks' asset quality to deteriorate over the last five quarters?

Impact from commodity prices is one.

Over the next 12-18 months, the pace of problem loan creation should slow, compared to the elevated levels seen in 2015, although it may still be higher when compared to the levels seen in 2010-2014, according to Moody's Investors Service.

"At the same time, the banks' balance sheet buffers should remain strong over the next 12-18 months, such as to withstand a deterioration in asset quality."

Here's more from Moody's:

While there was only a marginal increase in NPL ratios since end 2014, there was a substantial increase in the amount of restructured loans. The restructured loans helped the banks to understate their total non-performing loans (NPLs). If we make adjustments for the restructuring, we conclude that there was a meaningful deterioration in asset quality over the last five quarters.

The deterioration in asset quality over the last few quarters was driven by three broad factors: 1) weak economic growth; 2) impact of the fall in commodity prices; and 3) the lagged impact of some loosening of underwriting standards during 2010-2013. We see signs of improvement in two of the three factors — economy growth and impact from commodity prices — thereby forming the basis of our more optimistic view on asset quality over the next 12-18 months.

Advertise

Advertise