Lending & Credit

Hong Kong regulators calls on Chinese banks to review opaque lending rules

It singled out an unnamed Chinese lender that engaged in share pledging.

Hong Kong regulators calls on Chinese banks to review opaque lending rules

It singled out an unnamed Chinese lender that engaged in share pledging.

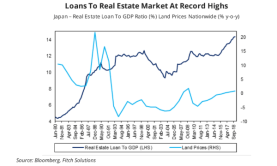

Chart of the Week: Japanese banks' real estate loans hit record high as risk appetite grows

Loans to the real estate sector as a share of GDP hit 14.4% in late 2018.

Indian banks grapple with $10m liquidity crunch

Lower government spending and higher cash withdrawal contributed to the deficit.

Maybank kills collaboration agreement with Tuaspring and Hyflux

It will appoint receivers and managers over the assets of Tuaspring, save for its desalination plant and shared infrastructure.

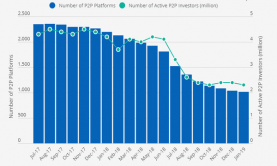

Chart of the Week: Chinese P2P players halved in 2018 amidst tougher regulations

Active P2P investors also fell 45.2% to 2.3 million.

Embattled Vietnamese banks take refuge in foreign investments

Japan-based J Trust Corp will buy a stake in Construction Bank for an undisclosed amount.

India could impose bad debt resolution rules on state banks: report

Lenders are hit with a total bad debt of $146b.

Chinese megabanks caution against bad loans as year-end profits take hit

Lenders also sharply increased provisions for future bad debt.

Australian banks blame tighter credit checks for home loan decline

Applications dwindled despite unchanged loan success rate.

Indonesian banks' bad loan ratio down to 2.4% in 2018

The decline comes in spite of recent domestic rate hikes.

Vietnam drafts rules urging lenders to settle bad loans before dividend payouts

The rules will apply to credit institutions and not to state-owned commercial banks.

Delayed accounting rules bring reprieve to debt-ridden Indian banks

State banks would have to raise $16b in provisions in Q1 if the rules kicked into effect.

Soured debt outpaces growth of Philippine bank loans in 2018

Bad loans grew 16.17% even as total loans rose 13.6%.

Indonesia's 88 fintech lenders see opportunity in US$70b credit gap

With average loan sizes of US$35,000-200,000, farming remains the main opportunity.

Deutsche Bank establishes bad-loan buying unit in India

More than 29 asset reconstruction companies have been set up after 2002.

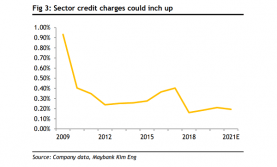

Singapore banks' credit costs to rise 5bp in 2020

The IFRS9 will require banks to set aside for anticipated losses.

Vietnamese banks urged to stem rapid lending

The loan growth of commercial banks hit 17-18% on average.

Advertise

Advertise

Commentary

Breaking barriers: Building the future of cross border payments in Southeast Asia

AI Governance: Navigating the Balance Between Innovation and Ethics